#1 Source For Veteran 500 FICO Score

Home Loans With Bad Credit In Florida

Florida Veteran

Home Loans

Have Questions? (352)444-4435

VA Home Loans

In Florida With Bad Credit

VA Mortgage In Florida For People With Bad Credit

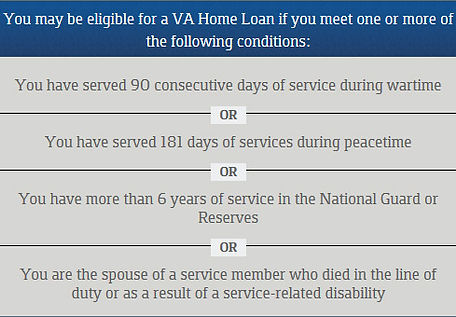

Thank you for your service and sacrifice! The Florida VA Home loan program is one of many great benefits you can earn by serving our country. Whether you're a veteran, an active duty servicemember, a surviving spouse, a member of the Special Reserves or National Guard and have bad credit or low fico credit scores.

Are you a Veteran and have bad Credit or low FICO scores 500-620?

We Can Help!

Looking to buy a home with your VA Home Loan Certificate

Who Can Get You Approved!

Purchase In florida With Bad Credit and $0 Down!

We Only Specialize In Bad Credit VA Mortgage Loans In Florida

100% Financing

No Down Payment!

No annoying phone calls and emails from multiple mortgage brokers or mortgage companys who can not help you.

VA Loans For Bad Credit In Florida

Bad Credit VA Loans In Florida?

We Can Help!

Bad Credit VA Loan In Florida

100% Financing

No Down Payment!

Free credit reports from all 3 bureaus

See your credit scores and the rationale behind them, free

Fast approvals - as soon as 30 minutes

Get your Pre-Approval letter in 30 minutes

Purchase In florida With $0 Down!

How it Works

Request A Free Quote In Less than 5 Minutes:

1. Fill out our simple form

2. Get One Quote from One Bank with the best rate

3. Close your VA Loan within 30-40 days

All form is secure. Encrypted with 128 bit ssl.

A Certified FICO™ Professional is an loan originator that has participated in special Education specific to the FICO™ credit scoring system and has proven knowledge by passing rigorous testing.

All Lending Network loan orignators are trained to help you begin a "Approval Plan of Action" - Your key to opening the door of closing your loan.

Here is how it works..

Say you applied for a mortgage but your credit score was just a few points shy of getting approved or getting the best possible interest rate due to an error on your credit report or a high balance accounts. If you tried to fix the error or paid down the balance, it could take several weeks for your credit report to be updated through the normal channels.

With rapid rescoring, you could improve your scores for a mortgage within a few days. If you paid down a credit card today, it might show up on my credit report 6-8 weeks from today, rapid rescore is simply a matter of providing documentation to the credit bureaus to get them to update information and shorten the normal reporting timetable. An updated score is typically generated within about 72 hours.

Loan originators look at your credit score from Equifax, Experian, and TransUnion, then base your eligibility and interest rate on your middle score, ignoring the high and low score. That means you’d only need to have the median score recalculated instead of recalculating all three.

Before going through the rapid rescore process, they will run a FICO simulator to estimate how much your credit score could be improved by paying down a balance or making other changes. The impact of a rapid rescore varies depending on what derogatory items were on your credit report, it could save a consumer thousands of dollars in interest over the course of a loan.

However, it’s important to note that a rapid rescore is different from credit repair. Credit repair is a separate process that often involves a third-party company disputing derogatory items on your credit report that may or may not be accurate. With a rapid rescore, you’d need documentation that you’d actually paid off a high balance or collections or that an item on your credit report was reported inaccurately.

Unless your median credit score already tops 740 (the cut-off credit score for the best interest rates), it’s probably in your best interest to consider a rapid rescore.

Free Rapid Credit Re-Score Program

Improve Your Score In 5-7 Days